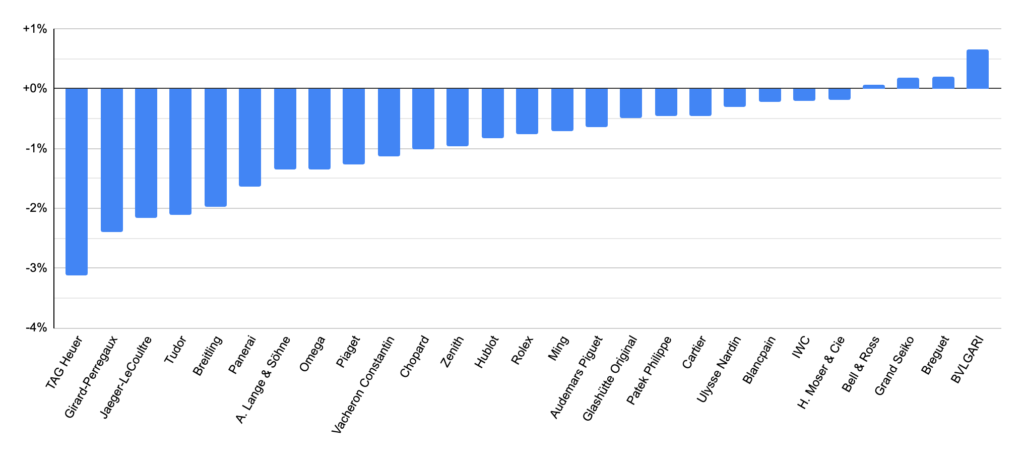

As discussed earlier, the high-end watch market is in a correctional phase. New watch sales are in decline and only a few brands still have waiting lists, and if so only for very specific models. The secondary market correction is in full progress and we’re still finding out what the bottom will be.

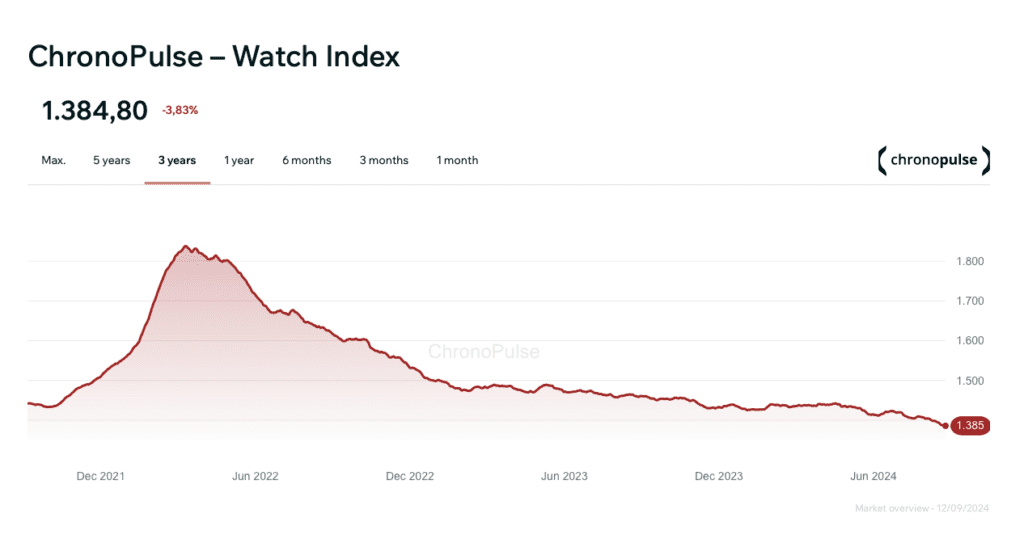

The Chronopulse Index (The “Dow Jones for watches”) is based on actual transactions on Chrono24. Looking at the 3-year index we clearly see the post-covid bubble, reaching its high in April 2022 and then popping. The correction that is following since is still declining, and the last index number (early September 2024) is at 1385 at its lowest point in years, and lower than before the bubble started.

Patek Philippe

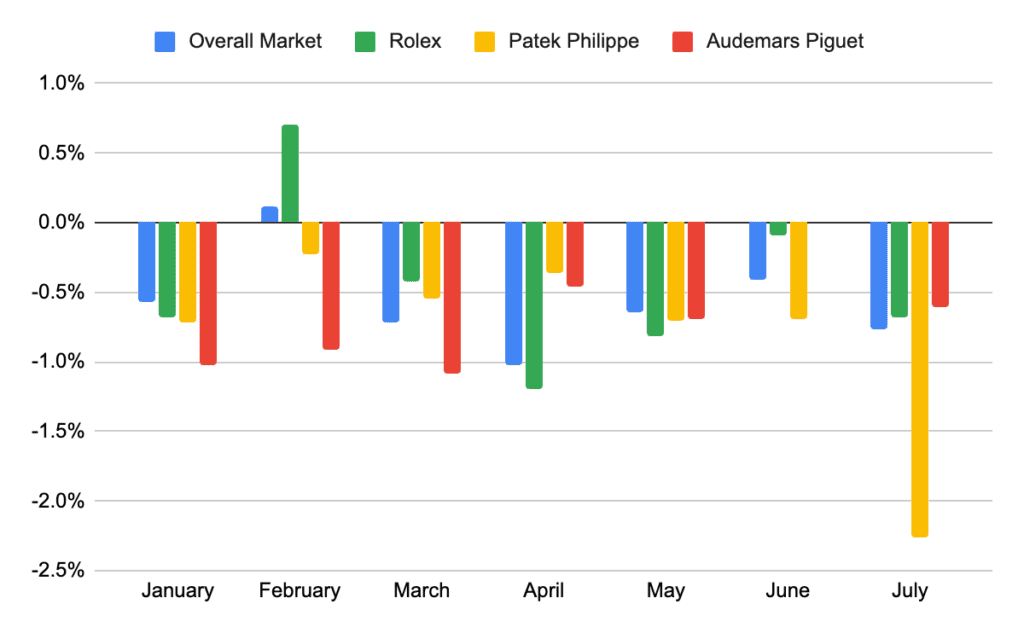

WatchCharts, another source monitoring the health of the market gives a similar view. The decline is still going on and shows no signs that the bottom is in. On top of that, their August report zoomed in on the 3 main brands and their performance over the past 7 months compared to the market. What we see in general is a mostly declining market where Rolex, Patek Philippe and AP or more or less on par with the overall market index. Some months the brands perform better, some months worse. However, the July graph shows an alarming figure for Patek. Almost 2.5% down in 1 month. What’s happening here?

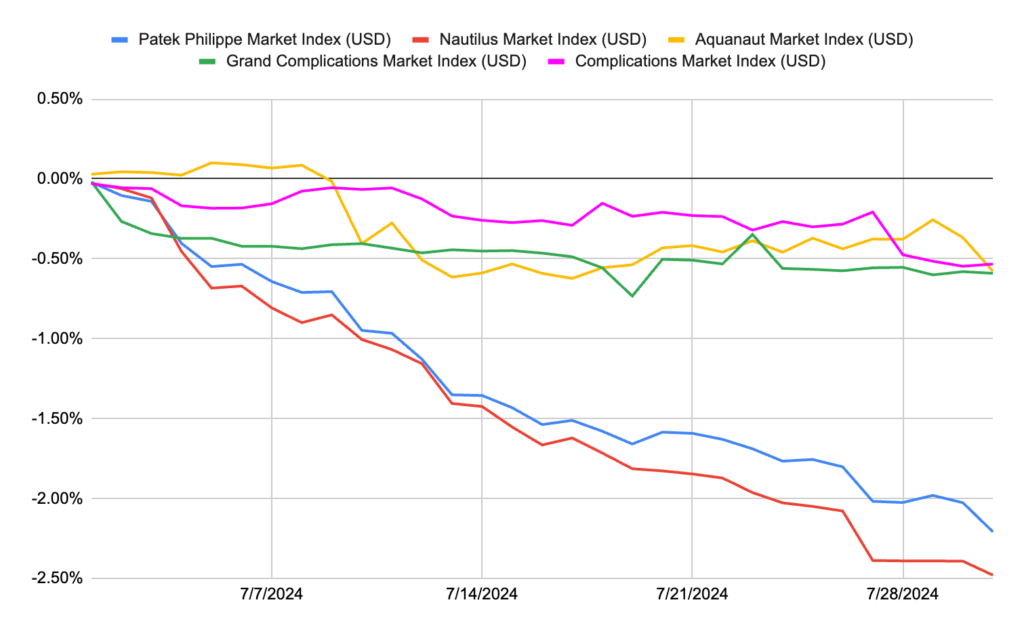

Watchcharts goes more into detail. The Patek market as a whole is defined by 4 elements: the Nautilus index, the Aquanaut index, the Grand Complications index and the Complications index. What we see is a modest decline for three of the 4 indexes, and only the Nautilus index seems to be falling off a cliff. And because of the relative weight (Being the most traded Patek I presume) this decline takes down the Patek market index as a whole.

Back to Chronopulse. The Patek index over the past year shows the same Patek trend and zooming in on July 2024 we see the index going down from 1879 to 1856 points, which is 1.2%. Individual Nautilus references show significant decline on the yearly basis, such as minus 8,73% for the 5712 and minus 7,64% for the 5711. And that is compared to last year, when the bubble was already bursted..

What will happen in the next few months will be indicative to whether we’ve bottomed with the market or will further go down. I wouldn’t be surprised if it’s the latter..

Thanks Watchcharts and Chronopulse for the charts.