The Chronopulse data on Chrono24 offers a wealth of information on where we are in the watch industry, monetary-wise. Based on actual transactions, Chronopulse follows the price movements on the secondary market over the past 5 to 6 years. Depending on chosen timeframe you can track the top brands individually and the market as a whole.

As mentioned in the previous article, the market developed a steep (and for some specific watches parabolic) increase in value up until April 2022, when the market peaked and a decline set in. We’re still in the process of some price discovery: Are we still correcting a bubble, or have watches failed as an asset class? A bit of both, I guess. A certain group of watches have qualified over the past 2 decades as serious collector pieces. Image and scarcity will make sure that the right Nautilus, Royal Oak or vintage Rolex will hold its value and increase over time. Perhaps not with the speed we witnessed between 2020 and 2022, but nevertheless.

Another group, also known as the majority of the watches, are not investment pieces. These watches are bought and sold for enjoyment and the first buyer loses money. You’re not buying a Girard-Perregaux, Frederique Constant or Hublot to “invest”. You enjoy it as a luxury product for yourself, and if you decide to sell you’ll hope to get a decent amount for it, although usually not anywhere near what you paid for. Of course, over time some older watches grow in appeal and scarcity, qualify as a widely regarded icon and rise in value. But those are the exceptions.

Is Hublot a better investment than Rolex?

Ok, let’s get back to the initial question. Not many watch collecting insiders will say yes as Rolex is obviously King of all Brands and almost an asset class on its own. And Hublot? Well, not so much. While Hublot is regarded as a big name in the industry and well respected, Hublot watches don’t have the reputation of holding their value. Let’s see what the numbers tell us.

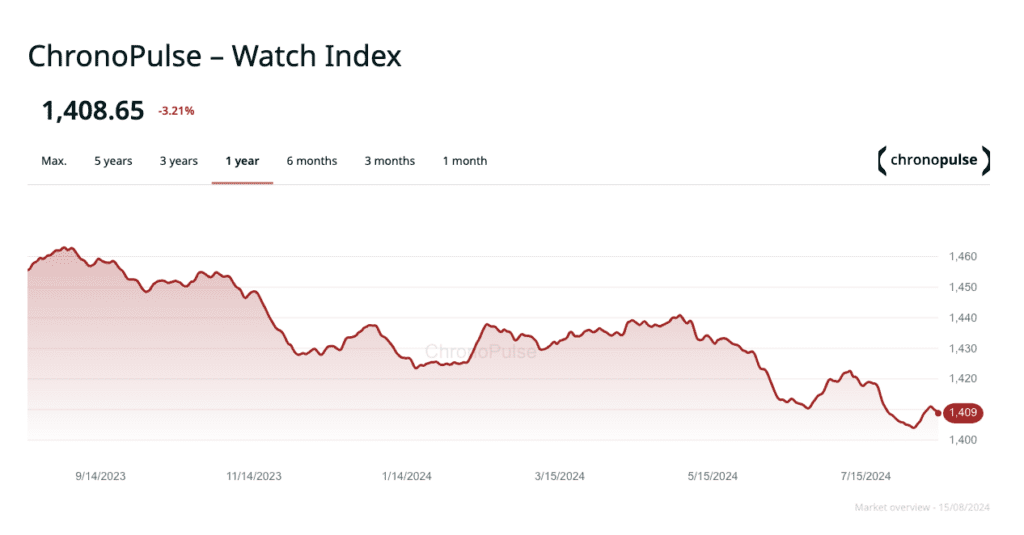

I chose to look back at the “post-boom” period, and focused on price developments of the last year. What is the value development of a watch you bought a year ago. If we look at the market as a whole, we see the cooling down continuing with an overall decline of 3,21% in the past 12 months.

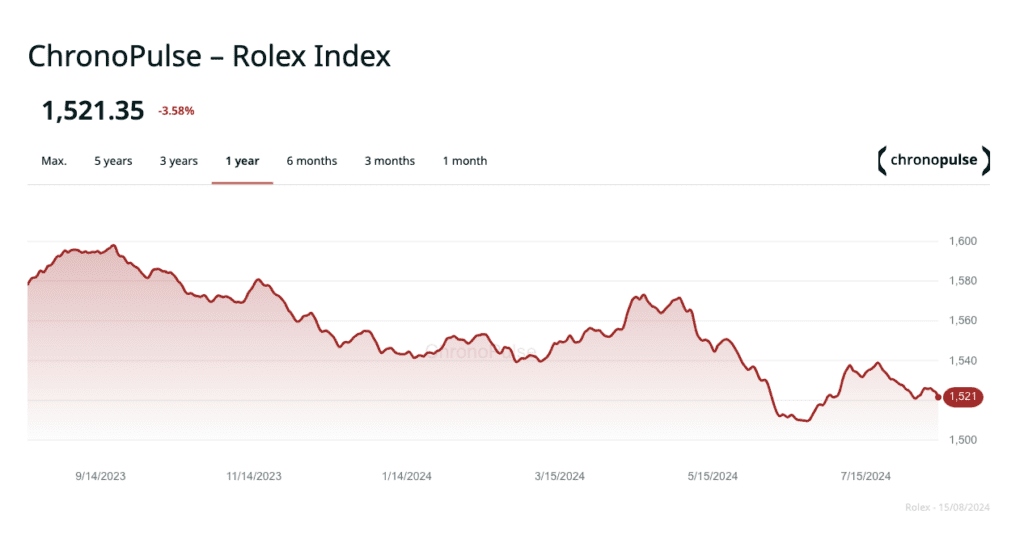

Rolex is slightly outperformed by the market with a 3,58% decline in the past 12 months. No surprises here: A brand that has firmly outperformed the market in the previous 5 years is likely to correct a bit more, and everyone who invested in a Rolex 3 years ago still has a great return on investment. However, the short term ROI is negative and in the top 20 of Rolex sellers in Chrono24 only 5 have shown a positive ROI in the last year, with the GMT-Master Pepsi firmly at the top (+7,85%)

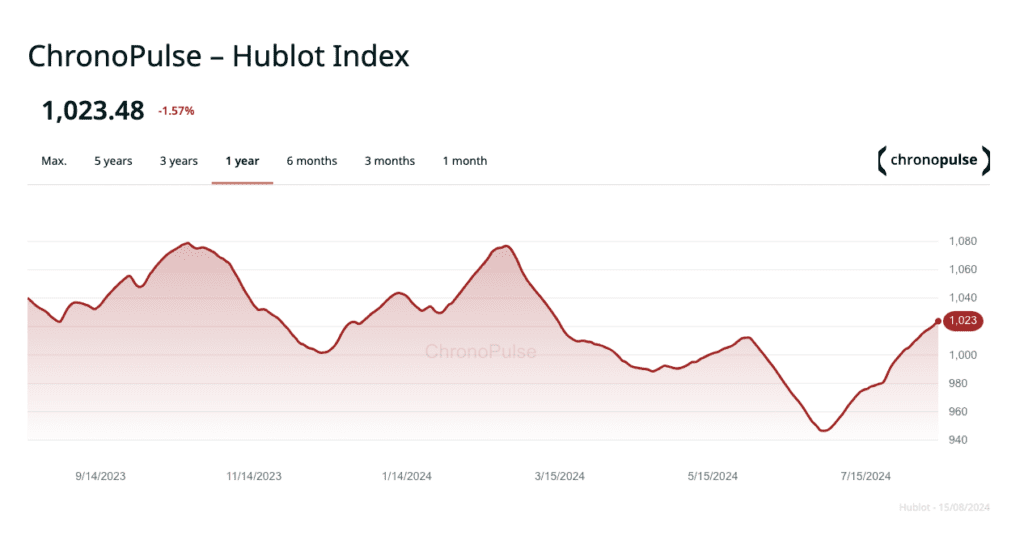

Hublot paints a different picture on the 1-year timeframe. Overall the brand declined 1,57% on average, outperforming the market. And amongst the top 20 sellers 10 references show a positive ROI, with the Spirit of Big Bang Mega-10 in the top spot: 16,98% value increase in 12 months! Worth mentioning is that some Classic Fusion models are also doing well, indicating that Hublot’s recent emphasis on their early designs is paying off.

What can we conclude here? That a Spirit of Big Bang is a better investment than a Rolex? I wouldn’t say so. The above exercise is a bit of cherry picking, as one could argue that looking over the past 12 months one misses the extensive gains that investment pieces like Rolex and Patek had before and during Covid. And what goes up extensively must come down. Zooming out, the investment potential of these brands are clear and will develop further.

At the same time one can value Hublot for its strength over the last year. Outperforming the market index and with a number of references growing in value it seems like Hublot is gaining attention in the pre-owned circles.